Report by Navindran Palasendaram

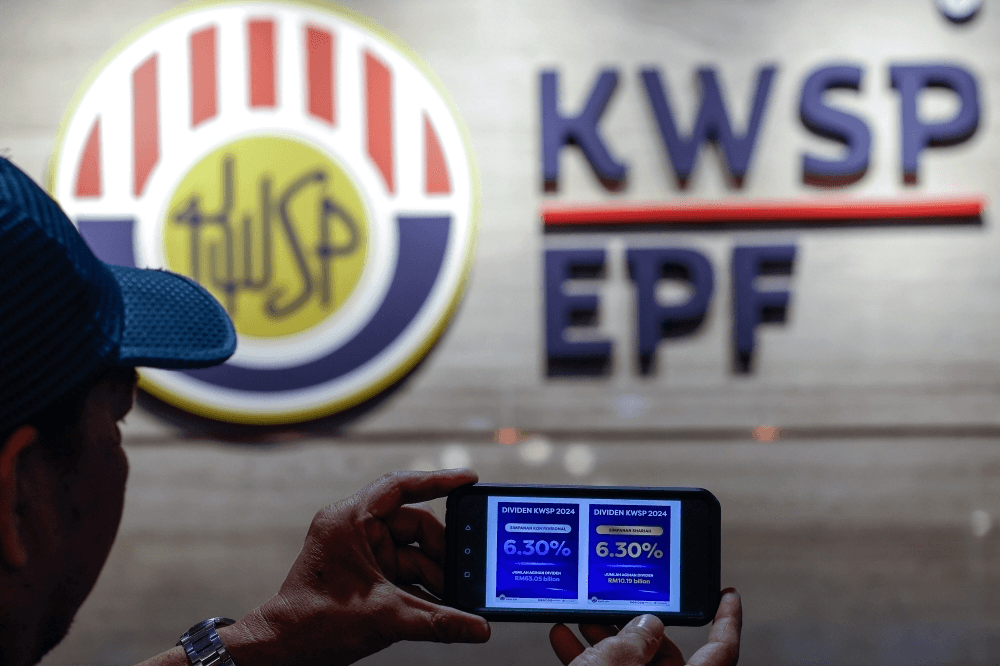

For many small and medium-sized enterprise (SME) owners nationwide, navigating the ever-evolving landscape of regulations is a constant challenge. A significant new policy is now taking effect, directly impacting businesses that employ foreign workers. Mandatory Employees Provident Fund (EPF) contributions for this segment of the workforce are now a reality. This shift, while aiming for broader social security, introduces both opportunities and notable challenges that every SME owner needs to understand.

Understanding the New Policy

Effective January 1, 2025, it will be compulsory for all foreign workers, regardless of their employment duration or wage level, to contribute to the Employees Provident Fund. Previously, this was largely optional for foreign workers, with many only contributing if their employers chose to facilitate it. Now, it mirrors the mandatory contributions for Malaysian citizens, meaning employers will also be required to make their statutory share to the fund for every foreign worker on their payroll. This move is part of a broader government effort to enhance social safety nets and ensure equitable treatment for all contributors to the Malaysian economy.

The Bright Side How This Policy Helps Businesses and the Nation

While the immediate reaction might be concern over increased costs, there are several potential upsides to this new policy, both for individual businesses and the broader economic landscape.

- This policy ensures foreign workers gain access to a crucial long-term savings scheme. This could lead to greater financial stability for them and potentially reduce instances of foreign workers being left without savings upon their return home, fostering a more responsible and ethical labor environment.

- In the long run, the increased cost of employing foreign workers might prompt some SMEs to explore automation or invest in upskilling local talent. This could align with national goals of reducing dependency on foreign labor and moving towards higher-value, technology-driven industries.

- This policy aligns Malaysia’s labor practices more closely with international standards, promoting a fairer and more equitable system for all workers, regardless of nationality. This could enhance Malaysia’s reputation on the global stage.

- The combined contributions from foreign workers will bolster the nation’s overall savings pool, potentially providing more capital for domestic investments and economic growth.

The Challenges Ahead What SME Owners Will Face

Despite the broader benefits, SME owners are rightly concerned about the immediate and tangible impacts on their operations.

- This is arguably the most significant immediate concern. Businesses, particularly those in labor-intensive sectors like manufacturing, construction, and certain F&B segments, will see a direct increase in their payroll expenses due to the employer’s share of EPF contributions. This pressure on profit margins could be substantial, especially for businesses already operating on thin margins.

- While the EPF system is well-established, integrating foreign workers into mandatory contributions will add to the administrative workload for SME owners or their HR departments. This includes registration, monthly deductions, and timely remittances, requiring additional time and resources.

- To absorb the increased costs, some businesses may find themselves compelled to raise the prices of their goods and services. This could, in turn, contribute to inflationary pressures and impact consumer purchasing power.

- SMEs competing with businesses in countries without similar mandatory contributions for foreign workers might find themselves at a disadvantage, especially in export-oriented industries where cost efficiency is paramount.

- If the increased costs make it less attractive to hire foreign workers, and if there isn’t a readily available local workforce to fill the gaps, some SMEs could face labor shortages, impacting their operational capacity and growth potential.

Moving Forward Adapting to the New Landscape

The mandatory EPF contributions for foreign workers represent a significant policy shift. For SME owners, it’s crucial to proactively assess the financial implications and adapt their business strategies. This might involve re-evaluating pricing structures, exploring automation where feasible, investing in local talent development, or optimizing other operational costs. While the policy aims to foster greater social security and fairness, its successful implementation will heavily depend on how SMEs navigate these new economic realities, balancing their bottom lines with the evolving regulatory environment.